All Categories

Featured

Table of Contents

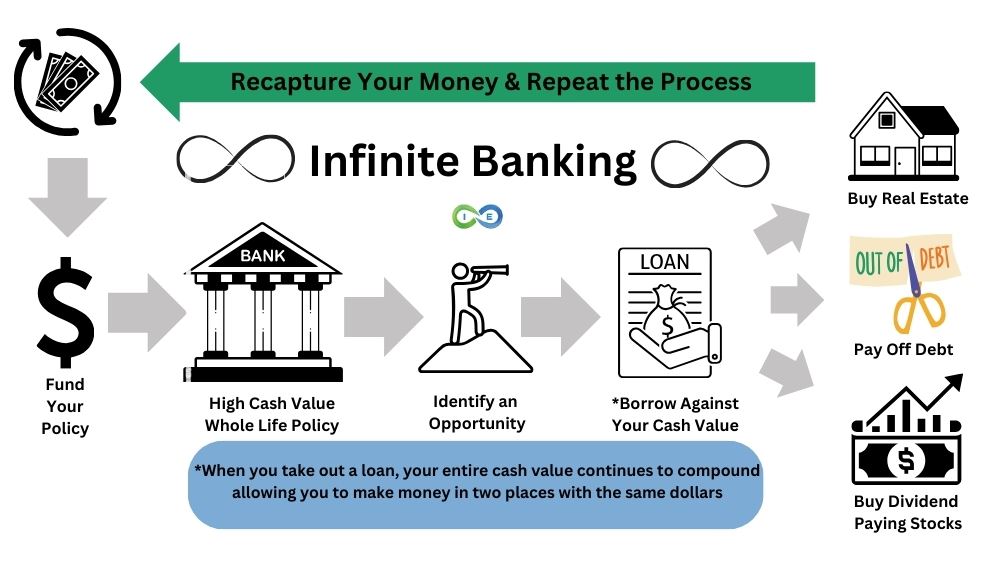

The approach has its own benefits, yet it also has concerns with high costs, intricacy, and extra, resulting in it being considered a rip-off by some. Limitless financial is not the most effective policy if you require only the investment element. The boundless banking principle focuses on the usage of whole life insurance policy plans as a financial device.

A PUAR allows you to "overfund" your insurance policy right as much as line of it becoming a Customized Endowment Contract (MEC). When you utilize a PUAR, you swiftly raise your cash money value (and your survivor benefit), thus boosting the power of your "bank". Further, the more money value you have, the greater your passion and reward settlements from your insurer will certainly be.

With the increase of TikTok as an information-sharing system, monetary recommendations and techniques have located an unique method of dispersing. One such approach that has actually been making the rounds is the infinite banking concept, or IBC for brief, garnering recommendations from stars like rap artist Waka Flocka Fire - Policy loan strategy. Nevertheless, while the technique is presently popular, its origins trace back to the 1980s when economic expert Nelson Nash presented it to the world.

What are the tax advantages of Self-financing With Life Insurance?

Within these policies, the money value grows based on a price established by the insurance provider. Once a significant cash money worth collects, insurance holders can get a money worth funding. These financings vary from traditional ones, with life insurance policy serving as security, implying one could lose their protection if loaning exceedingly without ample cash worth to support the insurance expenses.

And while the allure of these plans is noticeable, there are inherent constraints and risks, necessitating diligent money value tracking. The method's authenticity isn't black and white. For high-net-worth individuals or company owner, especially those making use of strategies like company-owned life insurance policy (COLI), the benefits of tax breaks and compound development can be appealing.

The allure of boundless banking doesn't negate its difficulties: Price: The foundational need, a long-term life insurance policy plan, is more expensive than its term equivalents. Qualification: Not every person receives entire life insurance because of extensive underwriting processes that can exclude those with specific health and wellness or way of life problems. Complexity and threat: The intricate nature of IBC, combined with its threats, may prevent lots of, especially when simpler and less risky alternatives are offered.

How long does it take to see returns from Borrowing Against Cash Value?

Designating around 10% of your monthly earnings to the policy is simply not practical for most individuals. Part of what you review below is simply a reiteration of what has actually already been claimed above.

So prior to you obtain on your own right into a situation you're not planned for, know the following first: Although the principle is generally marketed therefore, you're not in fact taking a lending from on your own. If that were the case, you would not have to settle it. Rather, you're obtaining from the insurance provider and need to repay it with passion.

Some social media messages recommend making use of cash worth from whole life insurance to pay for bank card debt. The idea is that when you repay the finance with interest, the amount will certainly be sent back to your financial investments. That's not exactly how it functions. When you pay back the finance, a part of that rate of interest goes to the insurance provider.

How do interest rates affect Infinite Banking Account Setup?

For the initial a number of years, you'll be paying off the compensation. This makes it extremely tough for your plan to gather worth during this time. Unless you can afford to pay a couple of to numerous hundred bucks for the next decade or more, IBC won't work for you.

Not everybody needs to rely solely on themselves for economic security. Borrowing against cash value. If you require life insurance, below are some valuable pointers to consider: Take into consideration term life insurance coverage. These plans supply protection during years with substantial monetary responsibilities, like home loans, pupil fundings, or when taking care of young kids. Make certain to search for the best rate.

Can Self-financing With Life Insurance protect me in an economic downturn?

Imagine never needing to stress concerning small business loan or high rates of interest again. What if you could borrow money on your terms and construct riches concurrently? That's the power of unlimited financial life insurance policy. By leveraging the cash value of entire life insurance IUL plans, you can grow your wealth and obtain cash without relying upon traditional financial institutions.

There's no set funding term, and you have the freedom to decide on the settlement routine, which can be as leisurely as settling the financing at the time of fatality. This adaptability includes the maintenance of the car loans, where you can choose interest-only payments, maintaining the lending equilibrium flat and convenient.

Is there a way to automate Infinite Banking transactions?

Holding cash in an IUL fixed account being attributed passion can often be far better than holding the cash on deposit at a bank.: You've constantly dreamed of opening your own bakery. You can obtain from your IUL policy to cover the initial costs of leasing an area, purchasing devices, and hiring personnel.

Personal fundings can be acquired from standard financial institutions and cooperative credit union. Below are some vital factors to think about. Charge card can supply a flexible means to borrow money for very short-term durations. Nevertheless, borrowing money on a bank card is normally really pricey with annual percent rates of interest (APR) typically getting to 20% to 30% or more a year.

Latest Posts

Life Rich Banking

Becoming Your Own Banker And Farming Without The Bank

Start Your Own Bank, Diy Bank Establishment