All Categories

Featured

Table of Contents

We utilize data-driven techniques to assess monetary items and solutions - our reviews and rankings are not affected by marketers. Limitless banking has recorded the passion of lots of in the individual financing globe, promising a course to monetary liberty and control.

Limitless banking refers to a monetary approach where a specific becomes their very own lender. The insurance policy holder can obtain against this money worth for various financial needs, efficiently lending money to themselves and settling the policy on their own terms.

This overfunding accelerates the growth of the policy's money value. Unlimited banking provides several benefits.

What is the minimum commitment for Self-financing With Life Insurance?

It entails making use of a whole life insurance coverage policy to develop a personal financing system. Its effectiveness depends on numerous aspects, including the policy's framework, the insurance firm's performance and exactly how well the strategy is managed.

How much time does limitless financial take? Limitless banking is a long-lasting technique. It can take a number of years, often 5-10 years or even more, for the cash money value of the policy to expand completely to start borrowing against it successfully. This timeline can differ relying on the plan's terms, the costs paid and the insurance coverage business's efficiency.

Cash Flow Banking

As long as costs are present, the insurance policy holder simply calls the insurer and demands a finance against their equity. The insurance company on the phone will not ask what the funding will certainly be made use of for, what the earnings of the customer (i.e. policyholder) is, what other assets the individual may have to work as collateral, or in what timeframe the individual intends to repay the finance.

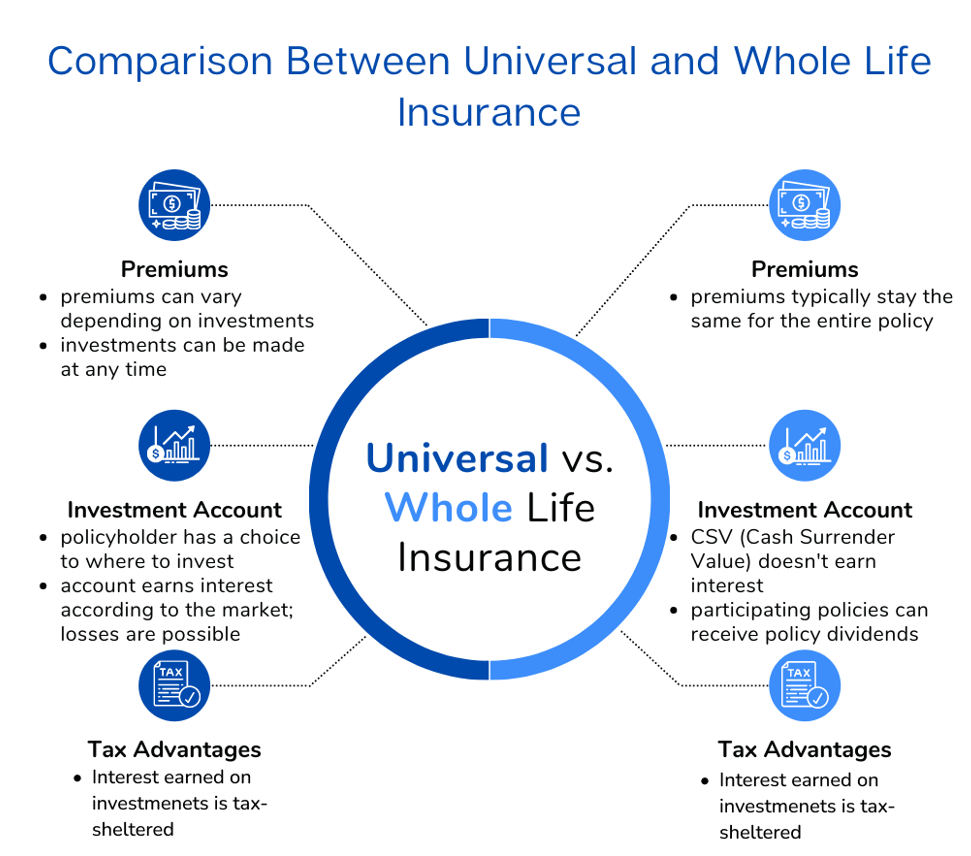

In comparison to term life insurance policy items, which cover just the beneficiaries of the insurance holder in the event of their death, entire life insurance covers a person's entire life. When structured effectively, whole life policies create a special earnings stream that increases the equity in the policy over time. For more reading on exactly how this works (and on the pros and cons of entire life vs.

In today's world, globe driven by convenience of comfort, too many as well numerous granted our nation's country founding principlesBeginning freedom and liberty.

What is the best way to integrate Infinite Banking Retirement Strategy into my retirement strategy?

It is a principle that permits the insurance policy holder to take finances on the entire life insurance plan. It must be readily available when there is a minute monetary burden on the individual, in which such loans may aid them cover the economic load.

The insurance holder requires to connect with the insurance company to request a finance on the policy. A Whole Life insurance plan can be termed the insurance policy product that gives defense or covers the individual's life.

The policy may need monthly, quarterly, or yearly repayments. It starts when an individual uses up a Whole Life insurance policy plan. Such policies may buy company bonds and federal government securities. Such plans preserve their values because of their conservative approach, and such plans never ever purchase market tools. Therefore, Boundless banking is a concept that allows the insurance holder to use up loans overall life insurance policy plan.

How can Borrowing Against Cash Value reduce my reliance on banks?

The cash or the abandonment worth of the whole life insurance policy works as security whenever taken finances. Intend an individual enrolls for a Whole Life insurance plan with a premium-paying regard to 7 years and a policy duration of two decades. The private took the plan when he was 34 years old.

The loan rates of interest over the plan is comparatively less than the standard lending items. The collateral originates from the wholesale insurance coverage policy's money or surrender worth. has its share of benefits and downsides in terms of its fundamentals, application, and performances. These variables on either extreme of the spectrum of facts are reviewed listed below: Unlimited financial as a monetary development improves capital or the liquidity account of the insurance holder.

Who can help me set up Infinite Banking Account Setup?

In monetary dilemmas and challenges, one can utilize such products to avail of fundings, consequently minimizing the trouble. It supplies the most affordable financing price compared with the conventional funding item. The insurance plan car loan can additionally be readily available when the individual is jobless or dealing with wellness problems. The entire Life insurance policy policy keeps its general value, and its efficiency does not connect with market performance.

In enhancement, one must take only such policies when one is monetarily well off and can take care of the policies premiums. Boundless banking is not a rip-off, however it is the ideal point the majority of people can opt for to enhance their monetary lives.

What are the tax advantages of Cash Flow Banking?

When individuals have boundless banking clarified to them for the initial time it seems like a wonderful and risk-free means to expand wide range - Infinite Banking cash flow. The idea of changing the despised financial institution with loaning from on your own makes a lot even more sense. It does call for changing the "despised" financial institution for the "hated" insurance company.

Obviously insurer and their representatives enjoy the principle. They created the sales pitch to sell more whole life insurance policy. However does the sales pitch measure up to actual world experience? In this post we will initially "do the math" on limitless banking, the financial institution with yourself ideology. Because followers of infinite financial might declare I'm being biased, I will use display shots from an advocate's video and link the whole video clip at the end of this post.

There are two serious economic disasters built right into the limitless financial principle. I will subject these defects as we function via the math of exactly how limitless banking actually functions and exactly how you can do a lot far better.

Latest Posts

Life Rich Banking

Becoming Your Own Banker And Farming Without The Bank

Start Your Own Bank, Diy Bank Establishment